ITEM: Russia is now SWIFT-free. Russian banking giant Sberbank has been disconnected from the SWIFT global financial messaging system under a new set of sanctions approved by European Union leaders on Monday. “This sanctions package includes other hard-hitting measures: de-Swifting the largest Russian bank Sberbank,” European Council chief Charles Michel announced following the EU summit.

ITEM: The European Union has largely stopped importing Russian oil. After weeks of deliberation, EU member states have agreed in principle on a sixth round of anti-Russia sanctions, the bloc’s leadership announced after a meeting on Monday. Hungary and Bulgaria will keep buying Russian oil, but most other import routes will be blocked. EU Council President Charles Michel said the watered-down embargo will affect about 75% of Russian oil imports, with the percentage growing to 90% by the end of the year.

ITEM: India has replaced the USA as a primary customer for Russian oil. In 2021, the USA imported 6 million barrels of Russian crude per month. More than 24 million barrels of Russian crude were supplied this month, up from 7.2 million barrels in April, and from about three million barrels in March. The South Asian nation is set to receive about 28 million barrels in June, data shows. Last year, Russian crude exports to India averaged just 960,000 barrels per month, roughly 25 times less than this month’s total.

ITEM: China has publicly denounced the “rules-based international order” as a “US rules-based international order”. The “rules-based international order” it touts is actually the “US rules-based international order”, a hegemonic order to dominate the world with the house rules of its clique… The US places its domestic law above international law and international rules and willfully resorts to illegal unilateral sanctions and long-arm jurisdiction. Since the outbreak of COVID-19, Venezuela, Syria and Iran have been grappling with severe difficulties with a struggling economy and strained medical resources due to prolonged US sanctions. Under such circumstances, the US, rather than halting those sanctions, redoubled them, making things even worse for these countries. The international community sees with increasing clarity that the US only complies with the market competition principle and international trade rules it claims to champion when it suits US interests.

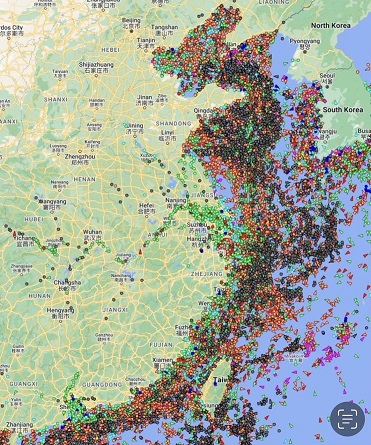

On the basis of these developments, I suspect that we are going to see China voluntarily and preemptively disconnect from the SWIFT and global trade systems later this year. China will likely be followed in this by India and a number of other anti-Clown World nations. This will not only trigger a serious financial crisis, if not a comprehensive banking collapse, but will likely lead to regime changes across Clown World. (Vox Popoli)

The REAL agenda behind the created food crisis

The REAL agenda behind the created food crisis